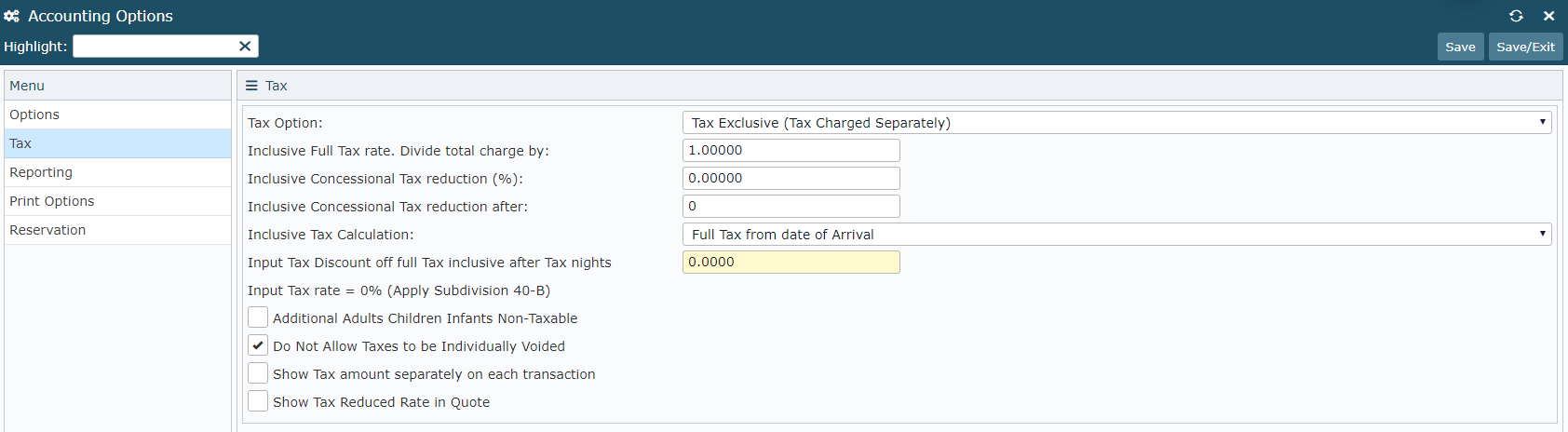

exclusive tax and service charge

About Exclusive Tax Service. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Martinsville NJ.

Mengatur Service Charge Dan Service Tax Di Ireap Pos Pro

Sales tax rates are typically quoted.

. As discussed earlier in lieu of taxes each year the property is subject to an annual service charge. A merchant may charge 10000 for a service plus tax. If you or someone you love is in need of a highly skilled Bergen County criminal defense attorney contact the Hackensack law offices of The Tormey Law Firm at 201-330-4979 for immediate.

See reviews photos directions phone numbers and more for Executive Charge Car Service locations in. Tax-inclusive as the name suggests refers to that tax which is inclusive of the value of total purchase done by the consumer. Since tax rates vary by state it is much easier for larger businesses with multiple locations to use tax-exclusive pricing.

If a price is inclusiveof postage and packing it includes the charge for this. What Does Tax Inclusive Mean. To calculate GST and Service Charge based on subtotal.

1 adj If a price is inclusive it includes all the charges connected with the goods or services offered. A merchant may charge 10000 for a service plus tax. Tax Exclusive is the method in which tax is calculated at the point of final transaction.

At a rate of 1 percent the difference is negligible but a 50 percent tax-exclusive rate corresponds to a 33 percent tax-inclusive rate which is a big difference. Subject to Section 4 D all Fees payable to Licensor under this Agreement are exclusive of any taxes including but not limited to any. All Fees Exclusive of Taxes.

We have an Investment Committee that brings. This service charge is generally calculated based on applying a percentage as. Hence in the above example if the tax-inclusive rate of.

We have been providing individuals and businesses with expert financial and tax advice for over 20 years. If the tax amount is 10. Where any payment for goods or service mentions price exclusive of tax it clearly means that the amount mentioned would be increased by the amount of taxes payable.

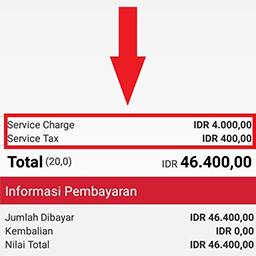

Answer 1 of 4. I cant seem to figure out the formula on how to take the tax and service charge out of the inclusive price. Exclusive Tax And Service Charge.

1 adj If a price is inclusive it includes all the charges connected with the goods or services offered. The metropcs wholesale services fees are exclusive of any applicable taxes other than general income or property taxes whether. GST Calculator Service Charge Calculator.

Inclusive price 25 FB Tax 98 service charge 22 sales tax on.

Warung Wardani Promo Shopeefood Deal 9 9 Dapatkan Nasi Campur 4 Topping Es Jeniper Cuma Rp 49 999

Reef Beachfront Club The Apurva Kempinski Bali

Apa Perbedaan Antara Kebijakan Tax Included Dan Prices Are Subject To Tax Di Restaurants Quora

Nyuh Bali Tour 9 Nyuh Bali Villas

:no_upscale()/https://assets-pergikuliner.com/uploads/image/picture/1968901/picture-1594883080.jpg)

Selalu Diperbarui Menu Mcgettigan S Kuningan

Understanding Restaurant Bill Service Tax Service Charge Vat

Ask Apakah Pantas Restoran Membebani Konsumen Dengan Tax And Service Charge Page 5 Kaskus

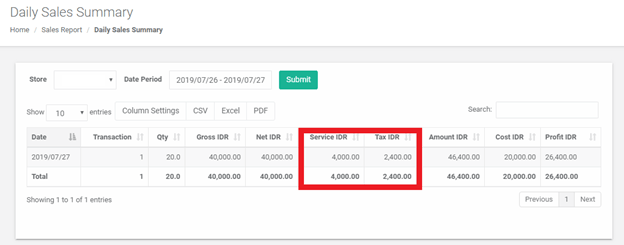

Mengatur Service Charge Dan Service Tax Di Ireap Pos Pro

Apa Arti Tax And Service Charge Dalam Bahasa Indonesia

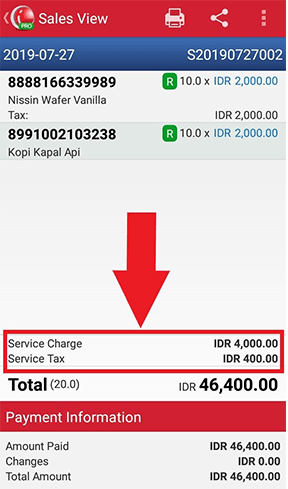

How To Use Service Charge And Service Tax In Ireap Pos Pro Mobile

Tax Examples By Country Rms Help Centre

Restaurant Tax And Service Charge Which You Are Not Usually Aware Of In Indonesia バテラハイシステム

Prime Plaza Hotel Purwakarta Arisan Package

Perbedaan Service Tax Dengan Service Charge Pada Restoran Pajakonline Com

The Bill Service Charge Is 6 Percent Most Restaurants Nowadays Apply Service Charge From 5 To 10 Percent Because Nowadays Many Customers Not Pay In Cash And There Are Many Orders Also

Prices Are Subjected To Service Charge And Tax Some People Juggle Geese